Maximize Your Savings With Expert Tax Planning For 30 Slab – Unlock Your Financial Potential Today!

Sep

23rd

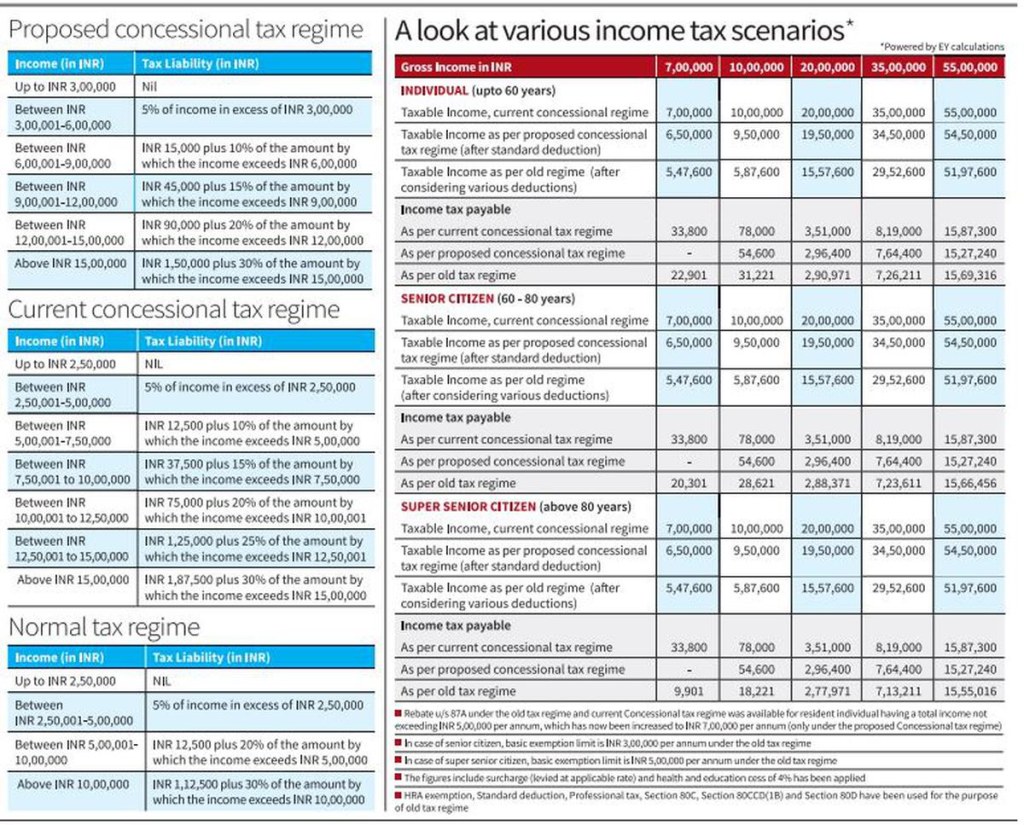

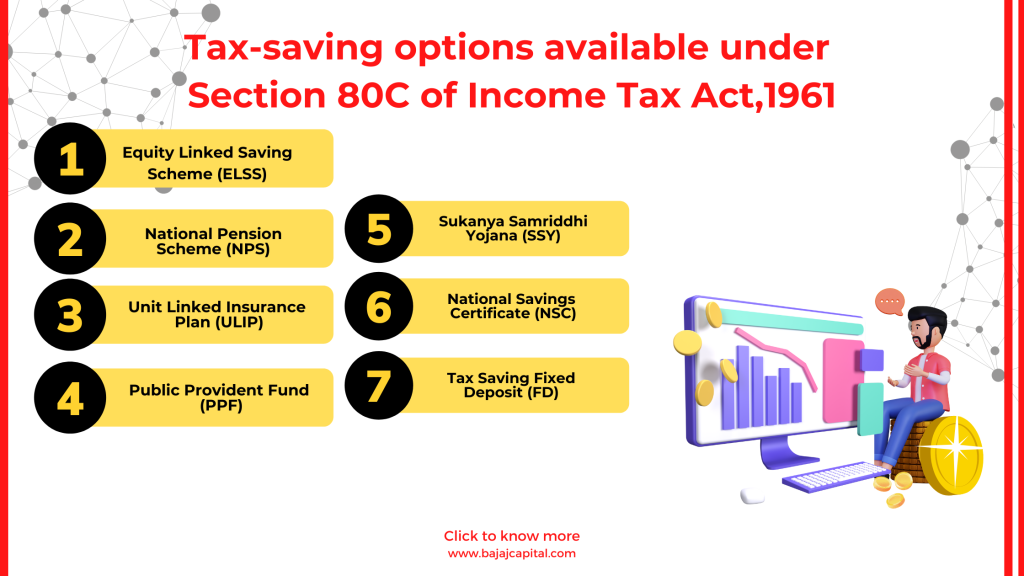

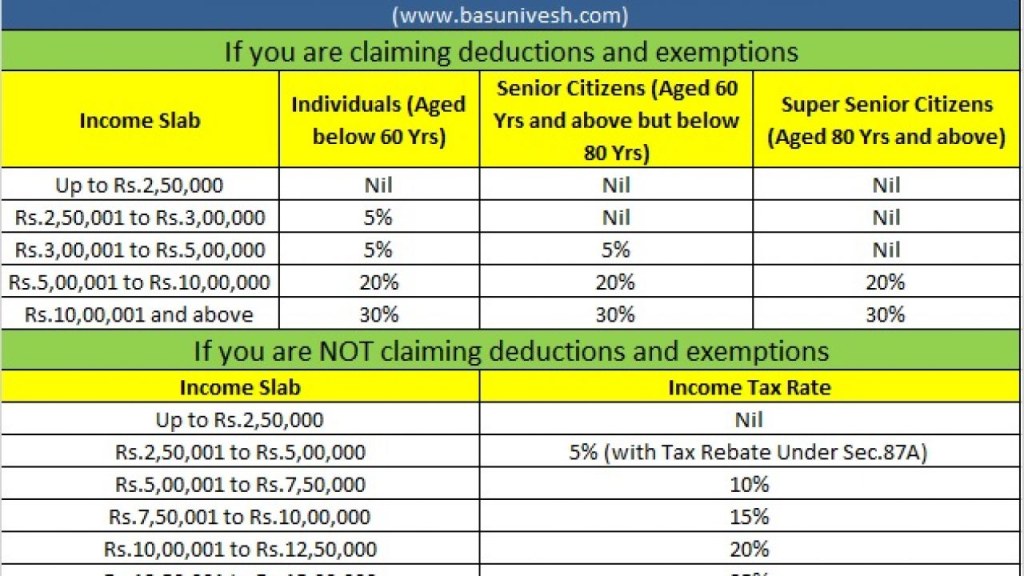

Tax Planning for 30 Slab Introduction Dear Readers, Welcome to our comprehensive guide on tax planning for the 30 slab. In this article, we will provide you with valuable insights and strategies to optimize your tax planning and maximize your savings within the 30% tax bracket. Understanding how to effectively plan your taxes is crucial for individuals and businesses alike,…